Just when you think all the puzzle pieces in life are starting to come together—you’ve got a new job, you’re learning the basics of budgeting, you’re in a great relationship — life happens and you find yourself needing to buy a new refrigerator to the tune of $1,500. 🥲

Knowing you don’t have that much to shell out, your best friend offers to lend you the cash. “It’s no big deal…pay me back whenever,” he tells you.

You nod your head in agreement and smile, thankful for the kind gesture. But your gut has a different reaction: “Do I really want to borrow from a friend?” Your sixth sense is telling you that something’s not quite right about borrowing this money with no strings attached.

Maybe you can’t pinpoint exactly what is making you feel uneasy, but it’s a valid feeling. is a tough decision to make, and without resources like a , it’s often a transaction that can have disastrous consequences.

Let’s take a look at five benefits that come from having an iron-clad loan agreement when borrowing from friends and family.

1. Promissory notes make the agreement legally binding

Sure you can write a promissory note on the back of a napkin, but having it neat and tidy in a digital document is better. Digital copies of your agreement are easy to refer back to, and no one will mistakenly toss it in the trash if they see it on your desk.

A promissory note should include:

- Names and contact information of the parties

- Interest rate

- Payment due dates

- Total amount owed

Including these elements means that your written agreement can be used as evidence in small claims court and will prevent your promissory note from potentially being invalid. You may opt to go a step further and notarize a promissory note for extra authentication.

2. A promissory note gives the lender peace of mind…

When you have a promissory note that’s legally binding, family and friends are more likely to agree to loan you some of their hard-earned cash.

Knowing there are options as to how to handle your loan if there is a borrower default, like going to small claims court, writing off the loss on their taxes, or forgiving the debt entirely reduces the risk that your lender is taking on. And that’s a good thing for both of you.

Even if you are certain you’ll make every payment on time, repay the loan in full, and your lender thinks they may never need to enforce your agreement, simply having one in place can eliminate any doubts and much of the stress that surrounds borrowing from family and friends.

3. …and doesn’t make your relationship weird

There’s a joke in the personal finance world that says that “Thanksgiving dinner tastes different when you owe money to your relatives”. Even if your lender is the sweetest person in the world, and you as a borrower are very intentional about repaying your loan, there’s a chance that one — or both — parties have a weird feeling about the borrower-lender dynamic of your relationship.

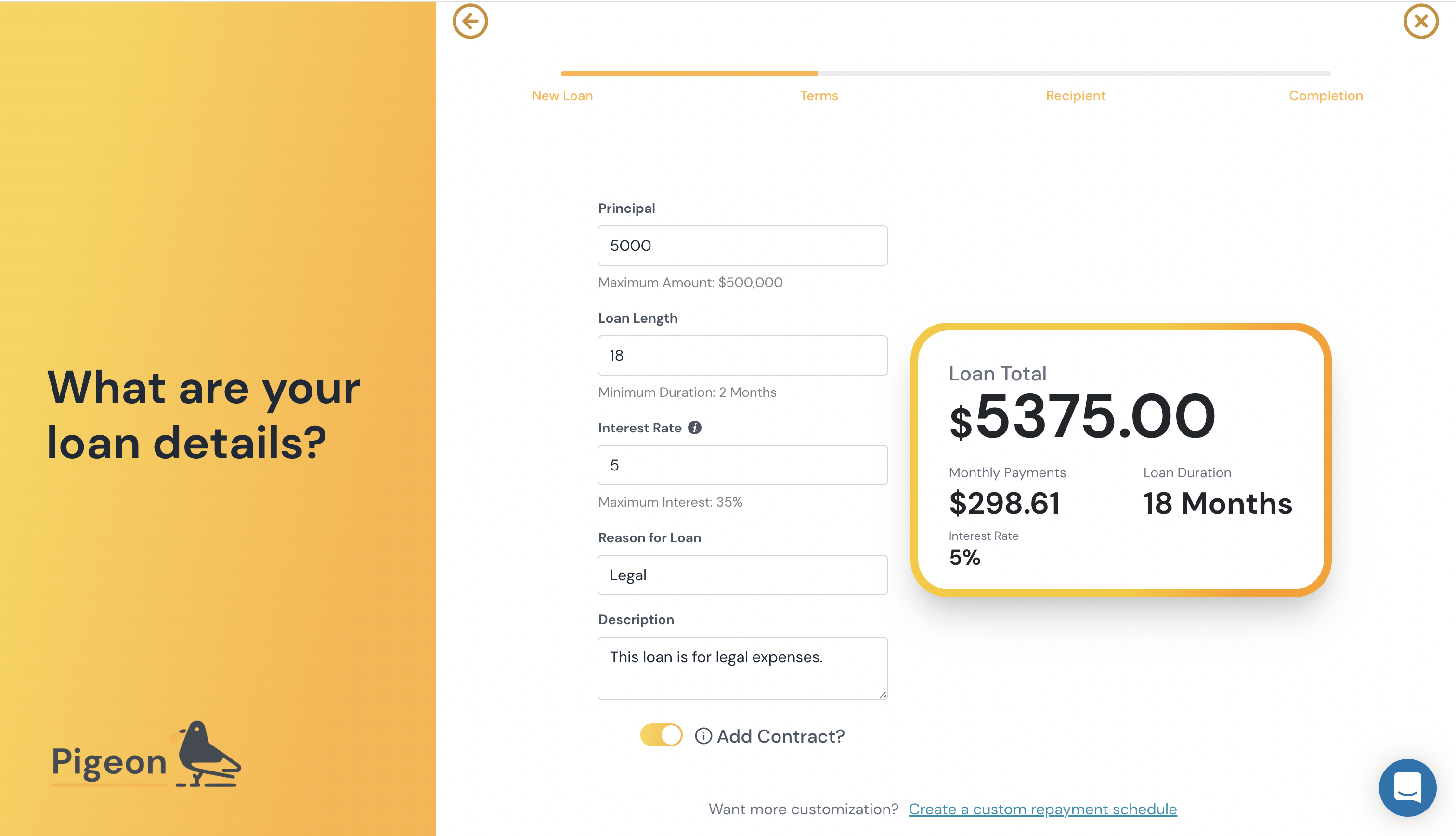

When you borrow that $1,500 from your brother with a promissory note, a binding promise to pay him something along the lines of $250 a month for six months plus interest, there’s less room for ambiguity.

When you use Pigeon to structure your loan, you have transparency and accessibility for both parties. Your brother will never have to awkwardly remind you to send a payment, you won’t have to exchange bank account information, and you’ll set all of this up in no time at all.

4. Promissory notes hold you accountable

Knowing that you have signed a promissory note motivates you to keep your word. Not that you wouldn’t repay your loved one, but without a formal agreement that one-year repayment term might turn into two or three, or even ten years.

When you have the terms of a loan written out in a promissory note, you’re more likely to treat this loan as seriously as you would a personal loan from a bank or your credit card payments.

5. Promissory notes keep records clear for Uncle Sam (and you)

People don’t generally think about the tax implications on the money borrowed from or lent to friends and family, especially if it’s a small amount. But since earning interest on money you lend out can be considered income, it's no surprise that "Uncle Sam" and other local tax authorities where you live may be entitled to a cut of the interest you receive as a lender. Documenting your loan terms in your promissory note will help you avoid the tax pitfalls of borrowing money.

Having crystal clear agreement terms and payment records is essential, especially if the loan amount is over $10,000. For these high-dollar loans, interest rates should also be set at or above the current Applicable Federal Rates because the IRS assumes that you are paying interest. While anyone who lends you money may be cool with giving you a 0% interest rate, due to taxes, your benevolent lender could unknowingly lose money by doing this.

Create a promissory note with Pigeon

By now, it’s crystal clear that having a promissory note isn’t just a good idea — it’s a necessity.

From outlining all of the terms of the loan to eliminating ambiguity and aiding in the event of a loan default, it helps to ensure that your experience in borrowing from family and friends is a great experience.

If you’re borrowing money from a friend or family member, having a contract (aka a promissory note) is the way to go! Download our free promissory note and loan agreement template today. 🏆

Want to read more related content? Check out some more of our awesome educational pieces below: