If you’re reading this, you are probably about to purchase a car—congratulations! 🤛

How do you plan to finance your purchase? If you're considering auto loans, you are probably concerned about getting the best interest rate. A great annual percentage rate (APR) on your car loan will help you save on monthly payments and give you more value for your money.

Car financing can be tricky, but don’t get overwhelmed. That’s what this article is for—to help you understand everything about APRs and how to get the best deal on your new or used wheels.

First, what is APR?

All car loans (not to mention personal loans, and almost all forms of debt) come with an annual percentage rate. It is the amount the lender charges you each year for borrowing and is a little higher than the base interest rate. This is because it covers the cost of servicing the loan yearly, which includes title and tax documentation, dealer prep, etc. A higher APR means higher monthly payments over the course of your auto loan. So it's important that you get the best deal.

APR Vs Interest Rate

While they are often conflated, the APR on a car loan is different from the interest rate. Your APR, as mentioned above, includes the cost of borrowing plus other added fees, while your interest rate is strictly your cost of borrowing, without other fees. Interest rates on loans are often influenced by the federal funds rate (in addition to other factors which we’ll go into below), and this is why they increase when the economy is booming and reduce during recessions.

What is the typical interest rate on auto loans?

According to Experian’s State of the Automotive Finance Market report in Q2 2022, the average loan rate on used cars is around 8.62%, while that on new cars is 4.33%. In Q1 of last year, the average auto loan interest rate was 8.70% for used cars and 4.12% for new vehicles, so there has been a slight increase and decrease respectively since then.

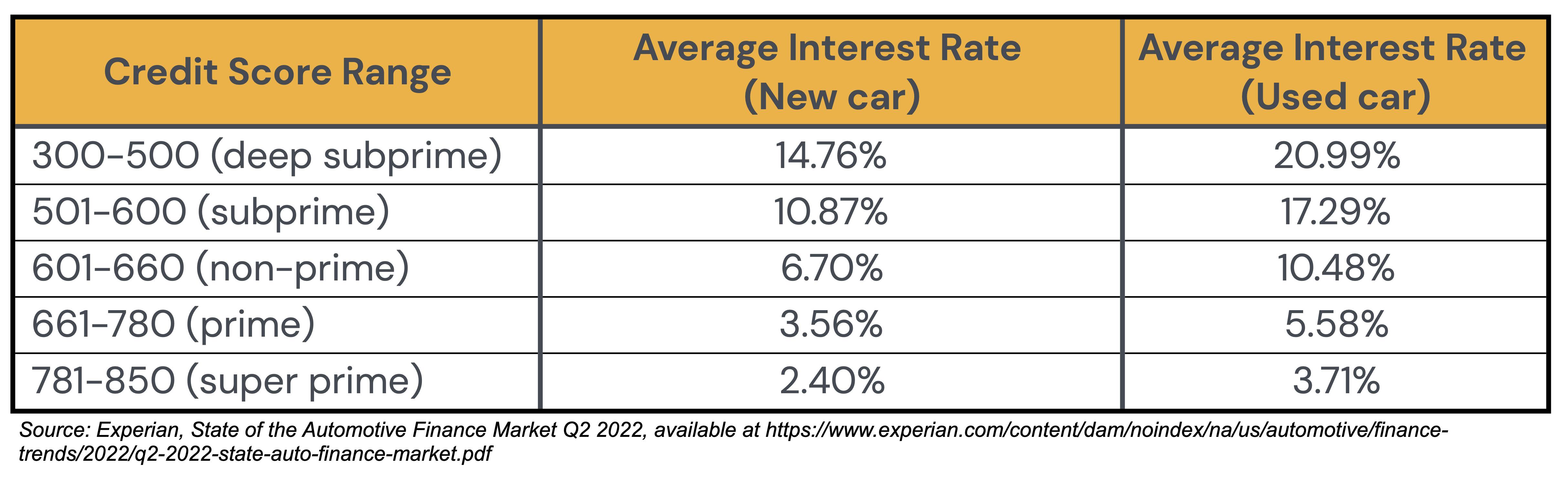

Experian collects data on average interest rates on car loans based on five credit score categories. The table below will give you insight into what loan rate you might expect on a new or used car according to your score.

That will give you an idea of what is too high or too low before you go shopping for a car loan. Knowledge is power! 💪

There are other factors at play, too—and we will explore what else affects your interest rate in more detail below.

What factors affect the interest rate on my auto loan?

As we mentioned above, your interest rate depends on a few factors like your credit score, the type of car you're buying (whether it’s new or used), your loan duration, and even your down payment. Let's look at them in detail.

1. Your credit score and credit history

Your credit score and history are among the most important factors determining your car loan interest rate. Lenders use your borrowing history to determine how risky it is to give you a loan. It's quite simple. The higher your credit score, the lower your interest rate on an auto loan, and vice versa. The table above shows that individuals with a good credit score get the lowest interest rate. In contrast, someone with a poor credit score of below 500 paid up to 12% more interest for the same car.

2. Buying a used vs. new car

In the table above you'll also notice that auto loan interest rates on used cars sat a few percentage points higher than those on new cars. This added interest protects the lender from the inevitable drop in the car's value over time and the risk that brings. Because new cars cost more and are still under warranty, lenders can afford to charge lower interest rates. Basically, used cars cost less and attract higher interest rates, while new cars cost more and attract lower interest rates on auto loans.

3. Length of the loan term

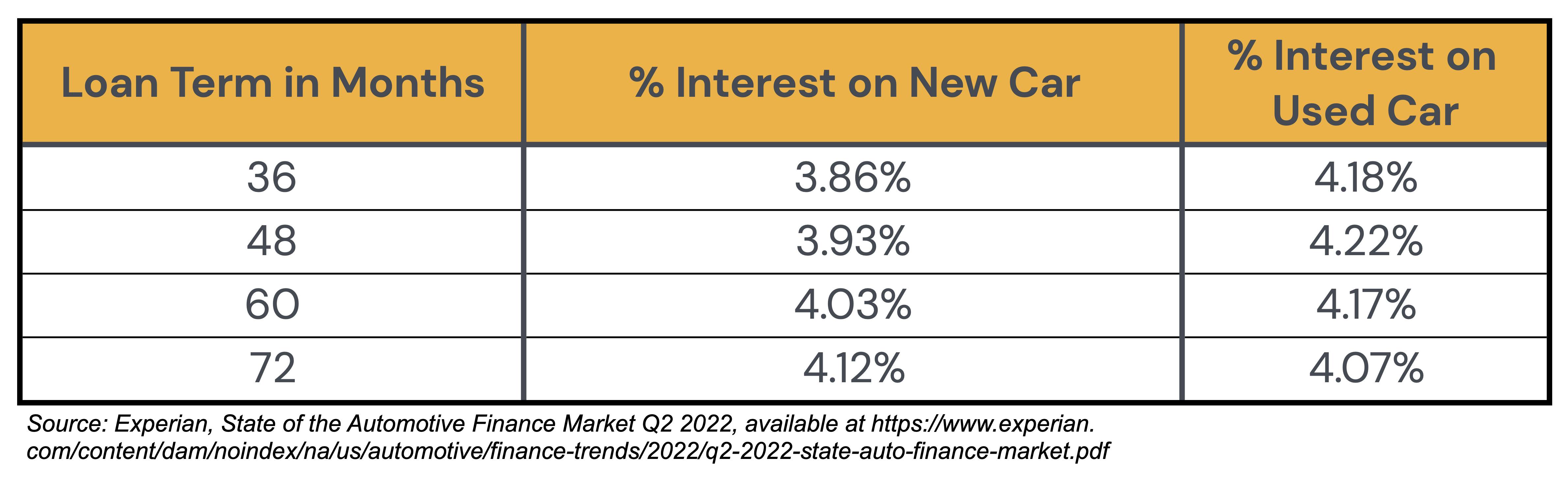

If your loan term is long, your monthly payments will be lower—but you’ll have a higher overall interest rate due to the higher level of risk involved. This means that you’ll pay more over the life of the loan.

Lenders often associate a long loan term (more than 60 days) with non or incomplete payment and will spike the interest rate slightly to protect themselves. For example, a 72-month loan interest rate on a new car is about 0.3% higher than a 36-month loan term on the same car. Interestingly, this increase tends to apply solely to new cars, while rates change minimally for used cars.

Data published in Experian's Q2 2022 State of the Automotive Finance Market report shows how much auto loan interest rates increase on new and used cars based on the loan term.

Bonus Tip: If you're buying a new car and financing with a car loan, try to avoid a loan term longer than 60 months. This will help to keep you from going underwater (where your loan balance becomes more than the market value of your car 😬) and also helps you save on interest.

4. Your down payment

The amount you put down is another factor that will determine your interest rate and APR. A bigger down payment means less money borrowed. Consequently, the lender is likely to charge a lower interest rate because there is less risk to the company. If you have a small down payment or nothing at all, the lender will charge a higher interest rate because of a higher risk of repayment default.

5. Your lender

While auto loan shopping, you will probably realize that initial interest rates on new and old cars offered by various institutions are quite different. Banks and credit unions will offer certain rates, as will other options like credit cards, dealership financing, and loans from family or friends like you can get on Pigeon. The type of car loan provider you settle for has a great impact on the interest rate you get.

These factors give you insight into what will affect the interest rate your lender presents. And to make buying a vehicle as affordable as possible, you should always do all you can to pay less interest on your car loan. We'll show you how.

How can I get a good interest rate on my car loan?

Like you, every financially savvy car buyer wants the best auto loan rate they can get. This is prized information we don't just give to anyone, so get your notepad and pens out. 📝 Ready?

1. Improve your credit score

You can get a car loan with bad credit, but improving your credit score before trying to get a car loan is a smart financial decision. Excellent credit not only gives you a lower interest rate, as discussed above, but it also makes upgrading your car or buying the next one super easy. Even the smallest improvement on your credit report can reduce your interest rate. So, sharpen your budgeting skills and start repaying those loans—especially if you’re in the subprime or deep subprime score categories (below 600).

2. Explore different lenders

Don't go for the first lender you meet. Take your time to consider multiple loan offers; you may be able to find a limited promotional offer with a super attractive interest rate and loan amount (depending on your credit score). Start looking at financial institutions and banks with whom you already have relationships.

Look into credit unions too, as these usually have lower interest rates for car loans than banks. It also helps to get pre-approvals from several online lenders a month before you're ready for a car purchase. Since these approvals are often valid for 30 to 60 days, you have enough time to compare the offers and find one that works best for you.

Finally, look even closer: your own friends, family, and other close relationships. People you trust are often willing to lend you some money to help you along your journey of life, and you can make that borrowing process much easier and better for you & the lender by using a platform like Pigeon. It’s free for both parties and gives you control over the amount, interest rate, duration, and more. If you have someone in mind already, get started creating a loan.

3. Negotiate strategically

Interest rates on car loans are negotiable, just like the price of the car. Usually, when you try to buy a car, the dealership will review your financial situation and work with one or two lenders to offer you a buy rate, which is the interest rate on the car loan. The dealership usually adds an amount to the real interest rate to increase its profit margin. So you always have some wiggle room to play with.

4. Pick a shorter loan term

If you can afford higher monthly loan payments, you can—and should—opt for a shorter loan term. This will reduce the total interest you pay on your loan and even boost your credit. So, instead of a 70-month loan term, go for a 36 or 60-month option.

5. Make a large down payment

As we pointed out earlier, a big down payment will considerably reduce the size of your loan and may also reduce the interest rate. This will translate to lesser monthly car payments and overall reduced costs. Saving up as much as possible before your car shopping endeavor is a great move.

6. Choose the right time

If auto loan interest rates and car prices are consistently high, consider waiting for a few months before trying to purchase one. These rates often fluctuate depending on the state of the economy. Who knows? You may get a car for a lower price and at a reasonable interest rate on the auto loan by just being patient—and you’ll also have more time to save for that down payment.

7. Get a cosigner

If you are looking at a high-interest rate because of your low average credit score, you can ask someone with a better credit history to cosign on the car loan for you. This will help you get a better interest rate and loan terms that are more favorable for you.

Now you know how to get a lower rate on a car loan. But what if you already have an auto loan and want to renegotiate the interest rate?

Can I renegotiate my car loan interest rate?

The answer is yes and no. You cannot change the terms of an existing car loan. However, you can choose to refinance your loan with the existing lender or a new one if;

- your credit score improves,

- interest rates on auto loans decrease in the economy, or

- you took a loan with a higher rate than what another lender offered you.

Refinancing an existing new or used car loan means revising the loan terms, which could mean interest rates, loan duration, payment schedules, or other factors. Once the new terms have been agreed upon by both you and the lender, the new car loan contract is signed and replaces the original one. Note that your financial situation will be thoroughly re-evaluated in this process.

Bonus tip: You can refinance your vehicle loan within 60-90 days of getting the original car loan. However, we advise you to wait at least six months before refinancing, as this will enable you to qualify for a lower interest rate based on your improved credit score (if applicable).

Whether you're buying new or used vehicles, a car loan can help make your dream a reality in no time—but it’s easy to be put off by a high interest rate. Knowing the factors that affect the APR and interest rate on your car loan, plus how you can reduce it, will help you get the best deal. Remember to take your time. Assess the market, consider your credit situation, and weigh your loan options. Use a popular loan calculator (we don’t have one, yet!) and be prepared to negotiate to get the best interest rate you can. You’ve got this! 🤜💥🤛

Want to read more related content? Check out some more of our awesome educational pieces below: